What Are Business Metrics?

Business metrics are quantifiable measures used to track the performance of a particular area of your business. They’re a way to evaluate progress toward goals and benchmark your efforts.

Individual teams or departments monitor metrics to ensure their part of the business remains healthy.

For example, marketing teams might track campaign effectiveness. Sales teams will focus on leads and revenue. And finance teams check profit margins and financial stability.

Each business metric you choose matters to the health and success of your company.

Why Track Business Metrics?

Businesses need to generate value. Your efforts should make a positive impact on your company’s reputation, customer base, and bottom line.

Tracking business metrics ensures that’s the case. It helps you:

- Assess company performance

- Identify problems

- Compare performance against industry benchmarks

- Ensure the company works towards shared objectives

- Set future business goals

- Provide stakeholders with important insights

But context is everything. The metrics you track should be relevant and measurable.

For example, tracking monthly revenue is an essential metric for a software-as-a-service (SaaS) company. However, if you don’t have paying subscribers, it might not be necessary to log that data.

Metrics vs. KPIs: What’s the Difference?

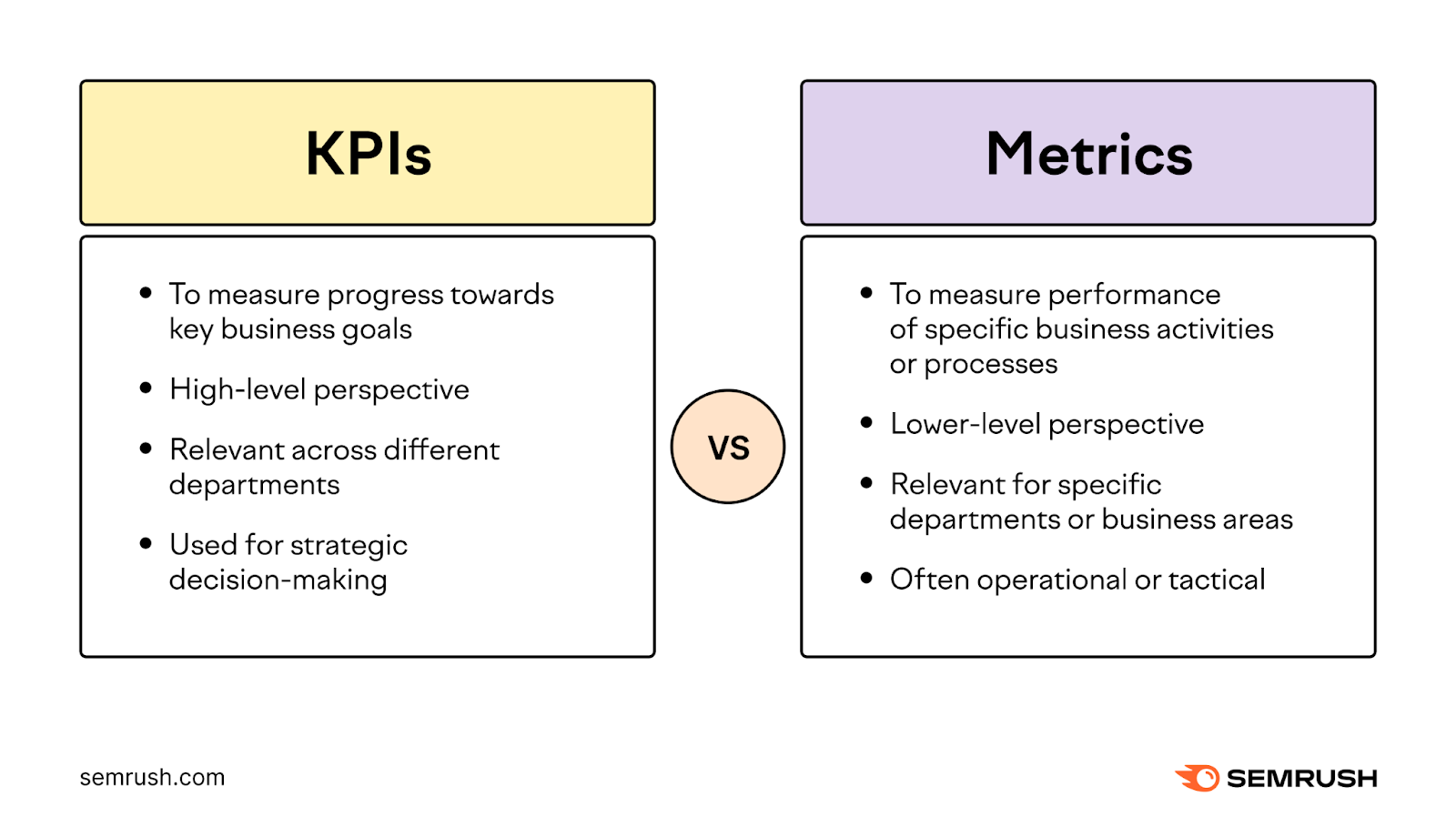

Metrics and key performance indicators (KPIs) are often used interchangeably. But they aren’t the same.

Metrics track performance. KPIs track outcomes.

Both metrics and KPIs are quantifiable measures. The difference?

A metric relates to business processes or activities, while a KPI is laser-focused on a target or objective.

Track metrics regularly while using specific targets and timeframes for KPIs.

For example, monthly website traffic is a useful metric to measure the growth of your website. But it’s not linked directly to a specific business objective like increased revenue.

So in this case, it’s not a KPI.

A KPI would be tracking organic search leads towards a goal (e.g., 500 new monthly leads by November).

This links directly to the objective—the more organic search leads you have, the more revenue you get.

If a metric helps you achieve better business outcomes, it can become a KPI. If a KPI doesn’t provide tangible results, it can become a metric.

With that in mind, let’s get into some of the most important performance metrics to consider for:

Further reading: 20 Marketing KPIs You Need to Be Monitoring

6 Business Metrics Marketing Teams Should Track

1. Monthly Website Traffic

Monthly website traffic shows how many people visit your landing pages. It’s a good way to gauge marketing and SEO performance. And make better use of your budget.

For example, if monthly traffic dips, you might allocate more resources to improve organic search rankings. Or invest more in advertising to increase visibility.

Pro Tip: Use Semrush to track keyword performance and monitor the impact of your SEO strategy.

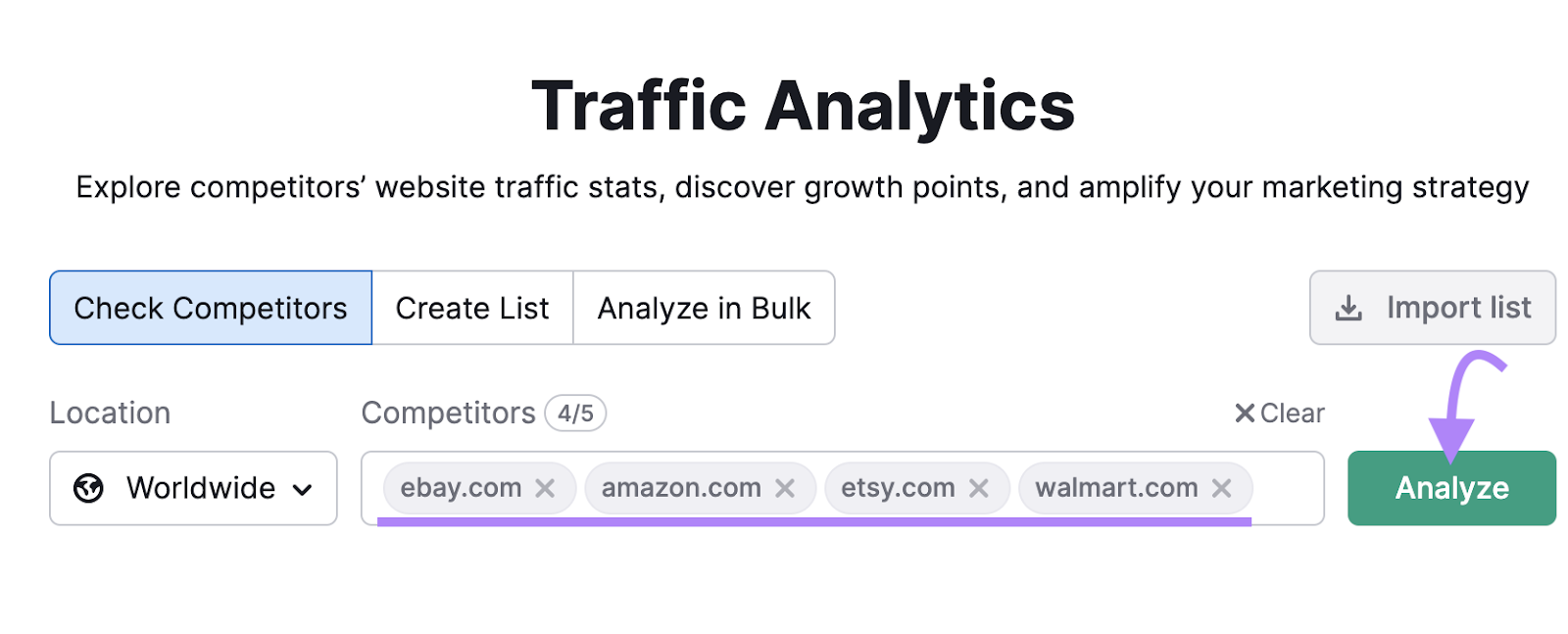

A tool like Semrush’s Traffic Analytics can show you traffic stats, sources, and trends across time for any domain.

To get started, enter up to five competitor URLs. Then click “Analyze.”

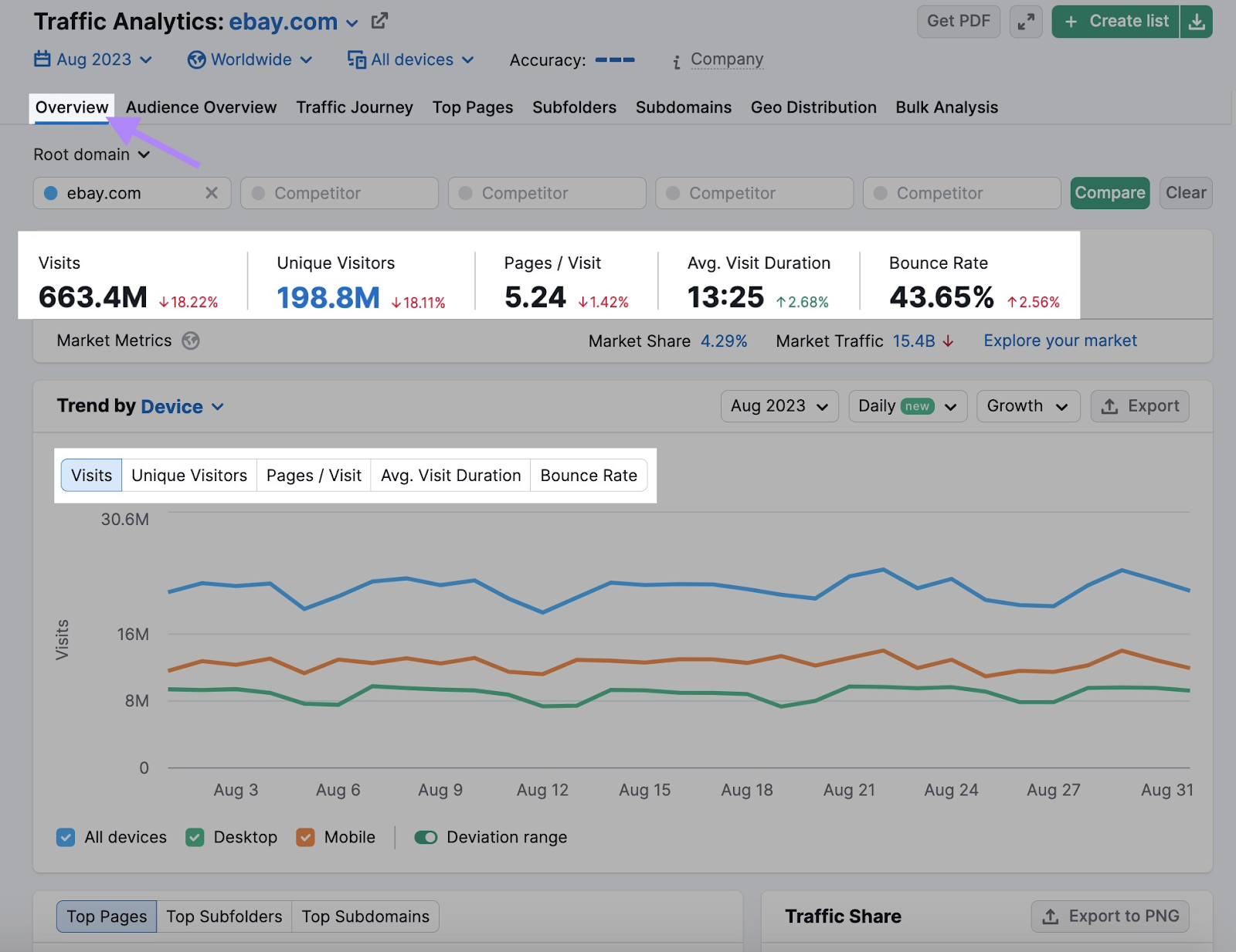

The Traffic Analytics Overview shows you key monthly data for:

- Visits

- Unique Visitors

- Pages/Visit

- Average Visit Duration

- Bounce Rate

Use the tabs to learn how competitors get traffic.

Click “Traffic Journey” to see which channels generate the most visitors. And “Top Pages” to see which sources are most popular.

Use this data to improve your marketing strategy.

Say a competitor’s blog post is driving a lot of organic search traffic to their page.

You can cover the same topic on your website. And improve on it.

Target similar keywords, but go more in-depth to create unique value. That will help you outrank competitor content.

Further reading: How to Drive More Traffic to Your Website

2. Conversion Rate

Conversion rate measures the percentage of customers who complete a desired action. For example, buying a product, signing up for your newsletter, or starting a free trial.

Tracking conversion rate is a good indicator of marketing strategy performance.

If the conversion rate on your website landing page meets expectations, it’s a sign that your SEO and conversion rate optimization (CRO) practices are having a positive impact.

However, if it’s down against internal or industry benchmarks, you’ll want to investigate what’s turning people off (e.g., design, functionality, or offer).

The formula to calculate conversion rate is:

Conversion rate = conversions / total unique visitorsSay you sent a discount code to 500 customers and 100 took action.

The conversion rate is 100 / 500 = 20%.

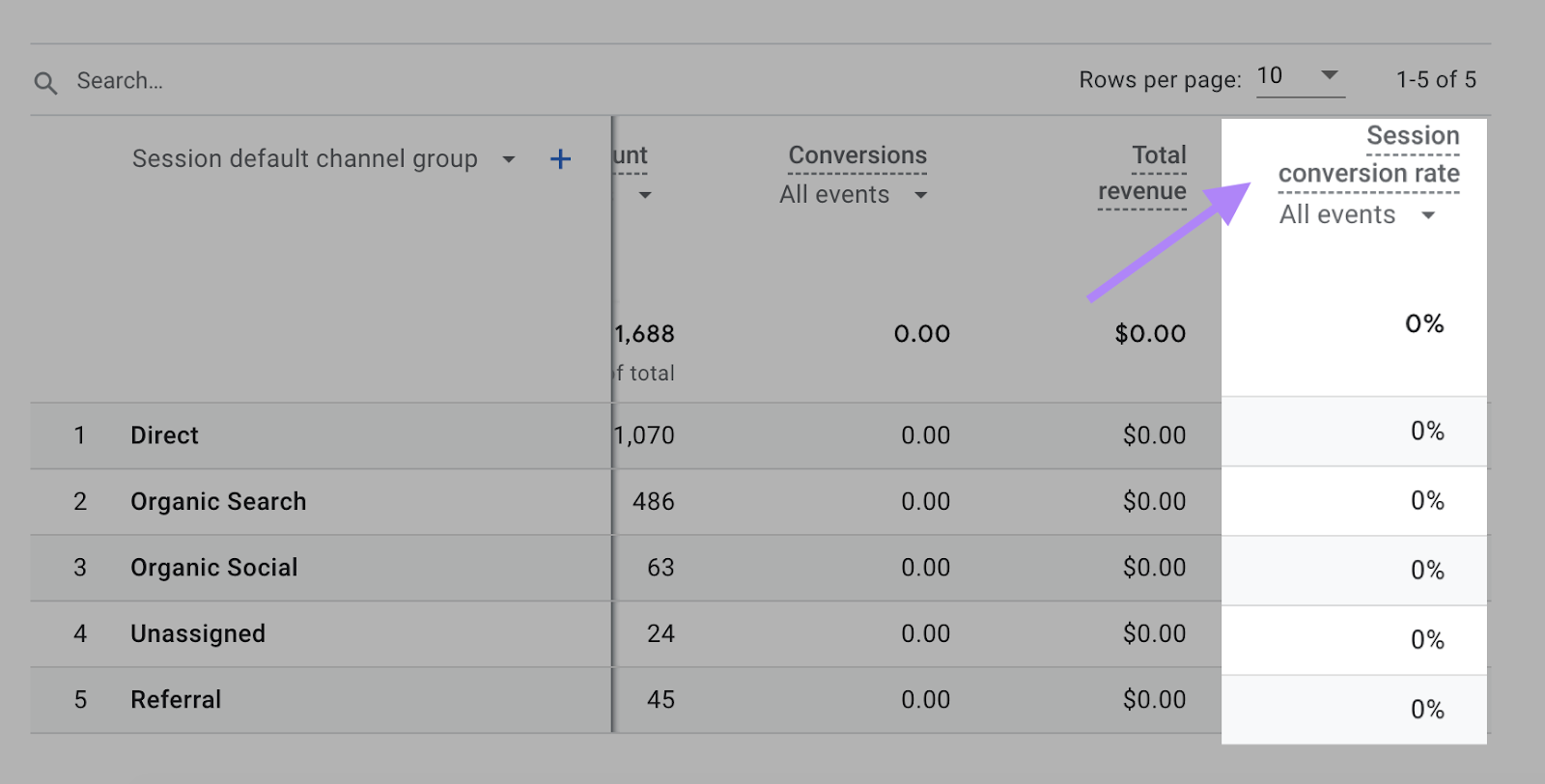

You can track conversion rate in Google Analytics 4 (GA4) reports. But first, you need to add it. Here’s how:

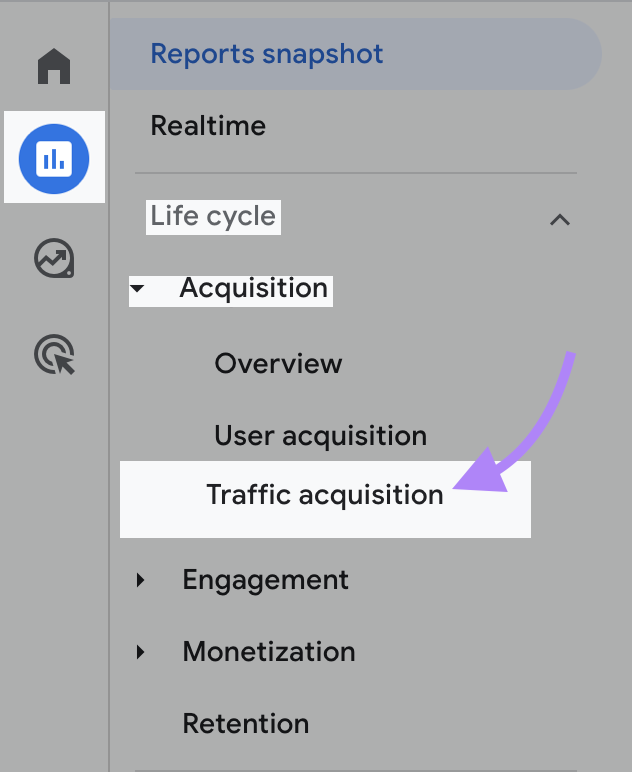

Go to “Reports” > “Life cycle” > “Acquisition” > “Traffic acquisition.”

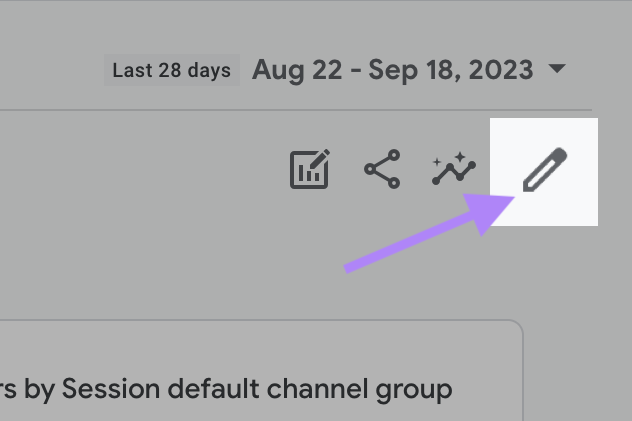

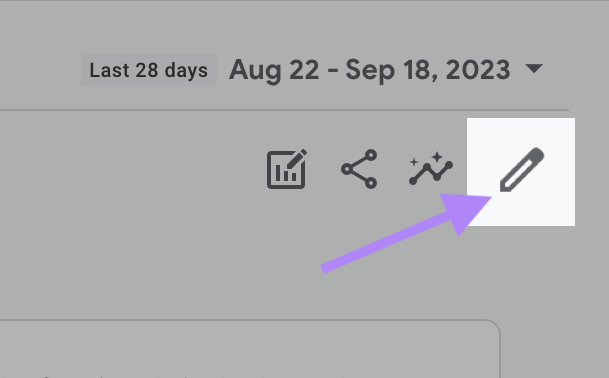

Click the pencil icon in the top right corner.

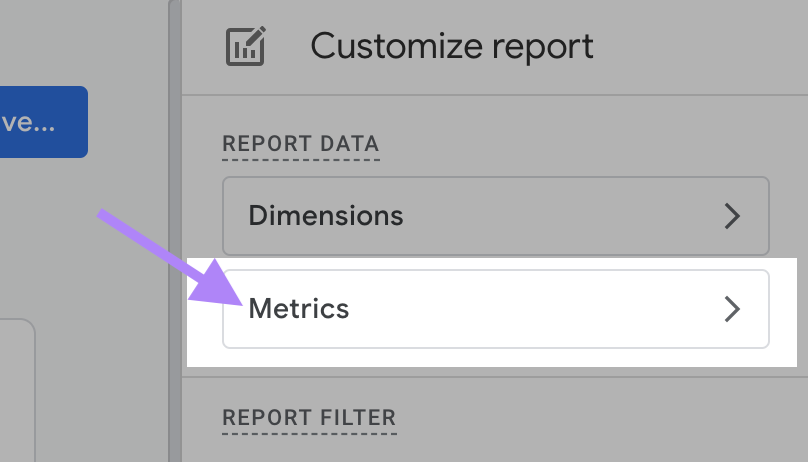

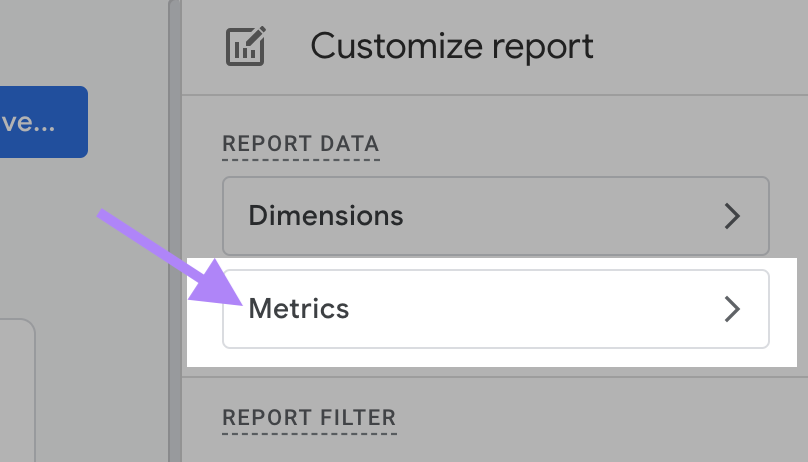

Click “Metrics.”

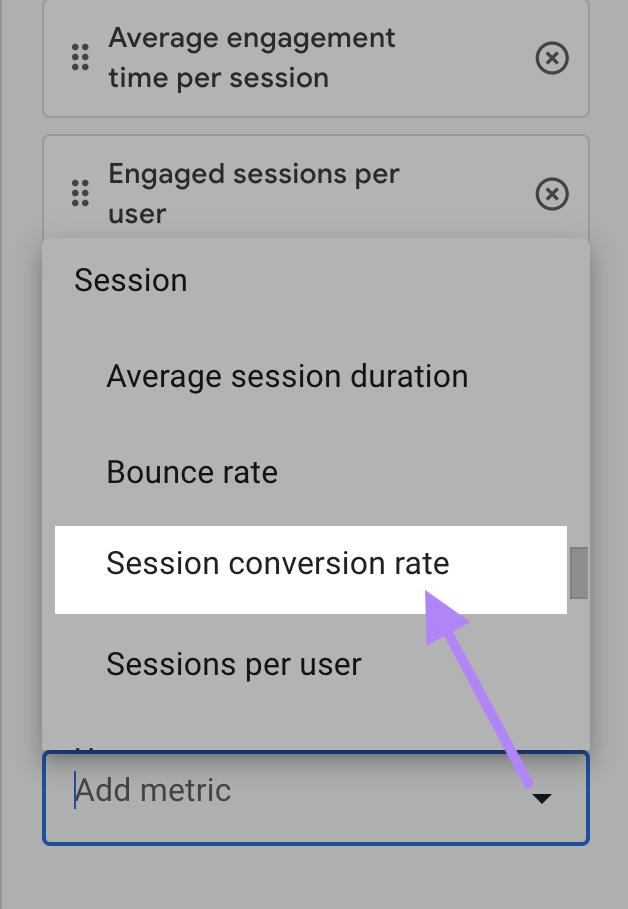

Click “Add Metric” and choose “Session conversion rate.”

Click “Apply” to add conversions to your traffic acquisition report.

You should now see it next to other metrics in your report:

Pro Tip: Learn how to use GA4 for SEO and marketing in our course How Data Helps Businesses Grow with Jeff Sauer.

3. Bounce Rate

Tracking bounce rate is important to ensure your marketing spend isn’t going to waste.

Bounce rate is the percentage of website visits that don’t result in a desired action, like clicking a link or making a purchase.

It’s calculated as follows:

Bounce rate = single page visits / total number of site visitsSo, if 100 people land on your website and ten leave without performing an action, your bounce rate is 10/100 = 10%.

A high bounce rate (over 20% for ecommerce or over 65% for blogs) could be a sign something isn’t right with a page. It might be due to:

- Slow loading speed

- Poor design or mobile optimization

- Disconnect between content and keywords

These factors impact customer experience and, ultimately, your conversion rate.

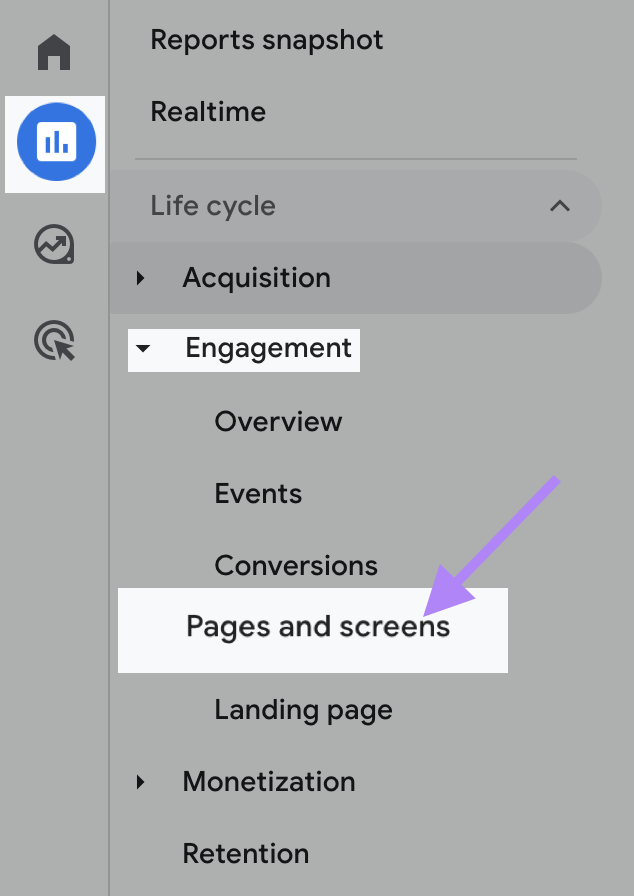

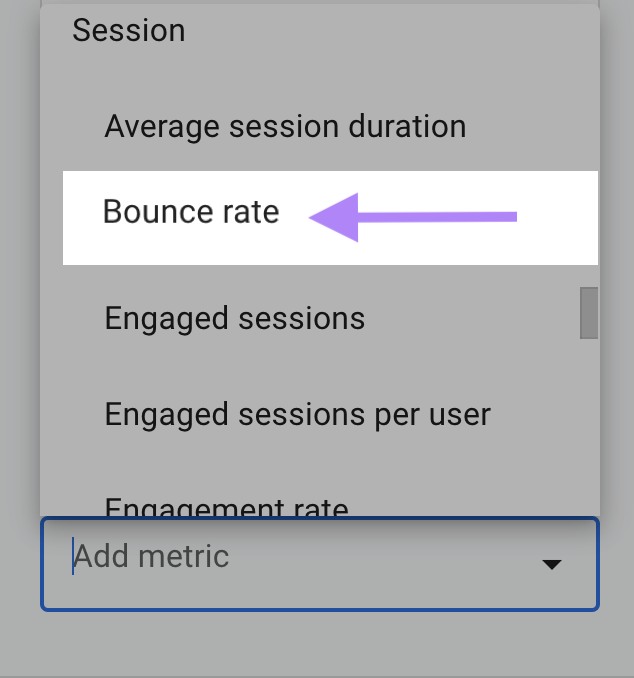

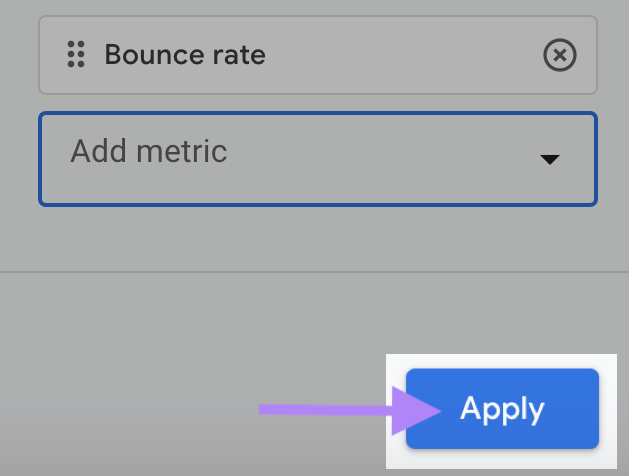

You can track bounce rate in GA4 by adding the metric to reports.

Go to “Reports” > “Engagement” > “Pages and screens.”

Click the pencil icon in the top right corner of the screen.

Select “Metrics.” Then “Add Metric.”

Choose “Bounce Rate” from the list.

Click “Apply.”

You will now see bounce rate in your engagement report.

Pro Tip: Use Semrush Traffic Analytics to benchmark your bounce rate against your top competitors.

4. Customer Acquisition Cost

Customer acquisition cost (CAC) is how much it costs to turn a potential customer into a buyer. It’s an important metric to measure your investment and make the right decisions for growth.

Why?

Because if your customer acquisition cost exceeds your revenue (and stays that way), you’ll likely go out of business.

CAC is the total cost of acquiring a customer. So it’s as much a sales metric as a marketing one.

It takes into account all marketing and sales costs. That includes everything you spend on campaigns, tools, salaries, and benefits.

Here’s how to calculate your CAC:

Customer acquisition cost = total marketing and sales spend / number of new customersSo if your total marketing and sales spend is $100,000 and you get 1,000 new customers, your CAC is $100,000 / 1,000 = $100 per customer.

To understand if your CAC is good or bad, measure it with Customer Lifetime Value (CLV).

5. Customer Lifetime Value

Customer lifetime value is how much revenue a customer generates during their entire relationship with you.

Like CAC, customer lifetime value isn’t strictly a marketing metric. But it does influence how much you’ll spend on campaigns.

If you know what you’ll earn from a typical sale, you can make better decisions about how much to invest to attract the right type of customer and boost profitability.

Calculate CLV as follows:

Customer lifetime value = (average transaction value x average number of transactions in a year x average customer retention in years) Here’s an example:

- Average transaction value = $200

- Average number of transactions in a year = 10

- Average retention rate = 3 years

Your LTV is $200 × 10 × 3 = $6,000.

Knowing this gives you context for your CAC.

If each customer is worth $1,800, acquiring them for $100 is a good deal.

6. Return on Marketing Investment

Return on marketing investment (ROMI) measures how much revenue a marketing campaign generates compared to the cost of running the campaign.

It ultimately tells you whether the time and money you spend on marketing is worth it.

You can calculate ROMI for individual channels or campaigns using the following formula:

Return on marketing investment = (sales growth - marketing cost) / marketing costFor example, you invest $5,000 in an influencer marketing campaign that generates $70,000 in sales at a 20% margin. The campaign contributes $14,000 to company profit.

Your ROMI would look like this:

- Sales growth = $14,000 ($70,000 × .20)

- Marketing cost = $5,000

ROMI = ($14,000 − $5,000) / $5,000 = 180%

Calculating ROMI alongside conversion rate and lifetime value gives you a clear view of marketing effectiveness. Use all three to convince stakeholders to invest in future marketing efforts.

4 Business Metrics for Sales Teams

1. Net Sales Revenue

Net sales revenue measures gross sales minus the cost of discounted, returned, or undelivered products.

It tells you whether people are buying your product and if marketing and sales tactics are working. It can also inform how you should move forward as a company.

For example, if revenue is up, you might ramp up production or increase advertising spend.

If revenue is down, you might tweak your approach to outdo the competition or research other markets.

Here’s how to calculate your net sales revenue:

Net sales revenue = gross sales - discounts - returns - allowances Say you have gross sales of $500,000, discounts of $10,000, returns of $15,000, and allowances of $10,000.

Your net sales revenue is ($500,000 − $10,000 − $15,000 − $10,000) = $465,000.

2. Sales Growth

Sales growth measures sales performance over a set period of time. It gives you an idea of how revenue is increasing or decreasing.

Track sales growth monthly and benchmark performance against the same months from previous years. That will help you spot patterns in seasons or customer moods.

For example, if you sell garden furniture, you might see sales increase during summer or decrease during unseasonably bad weather.

You can use this information to scale up sales activity during busy periods. Or ease off during quiet times to save money.

Sales growth also tells you how well your sales team is performing. If sales drop, it might indicate that your sales team is overworked, understaffed, or lacking efficient workflows.

Here’s the formula to work out sales growth:

Sales growth = (current year revenue - previous year revenue) / previous year revenueSo if your sales were $10 million this year and $8 million last year, your growth rate is ($10m − $8m) / $8m = 25%.

You can monitor sales in the backend of your sales platform (e.g., Shopify or Wix eCommerce). Or by using a sales customer relationship management (CRM) tool like Pipedrive, Salesflare, or monday.

Further reading: 10 Ecommerce Marketing Strategies & Tactics to Improve Sales

3. Lead Response Time

Lead response time is how long it takes a rep to contact a potential customer.

Why does this matter?

Because the quicker you respond to leads, the more likely you are to convince a customer to buy.

Tracking lead responses will help you identify top-performing sales reps and provide extra support to those who need it.

So you can build a sales team that capitalizes on every opportunity.

The formula for lead response time is:

Lead response time = time between lead creation and sales rep response for all leads / total number of leadsHere’s an example:

A sales rep responds to eight leads.

- Four leads: three minutes each

- Three leads: six minutes each

- One lead: eight minutes each

The lead response time for that day is (3 + 3 + 3 + 3 + 6 + 6 + 6 + 8) = 38 / 8 = 4.75 minutes

You can track individual response times automatically using a sales CRM platform like Salesforce or Pipedrive.

Further reading: 11 CRM Examples and How to Use Them

4. Churn Rate

If you rely on repeat customers, churn rate is a key metric to monitor retention.

Why?

Because it measures the percentage of customers who don’t renew a contract or subscription.

For a sales team, high customer churn is typically a sign customers aren’t engaged or satisfied. That could be due to your offer, approach, or increased competition.

In any case, it’s not good. It also has implications beyond the sales team.

For finance, it means falling sales. And for marketing, it means evaluating which campaigns or channels contribute to churn.

Track churn rate (monthly or quarterly) and benchmark performance.

Here’s how to calculate it:

Churn rate = number of customers lost during a period / number of customers at the start of a periodFor example, if you start Q1 with 3,000 customers and end Q2 with 2,000 customers, the number of customers lost is 1,000 / 3,000 = 33%.

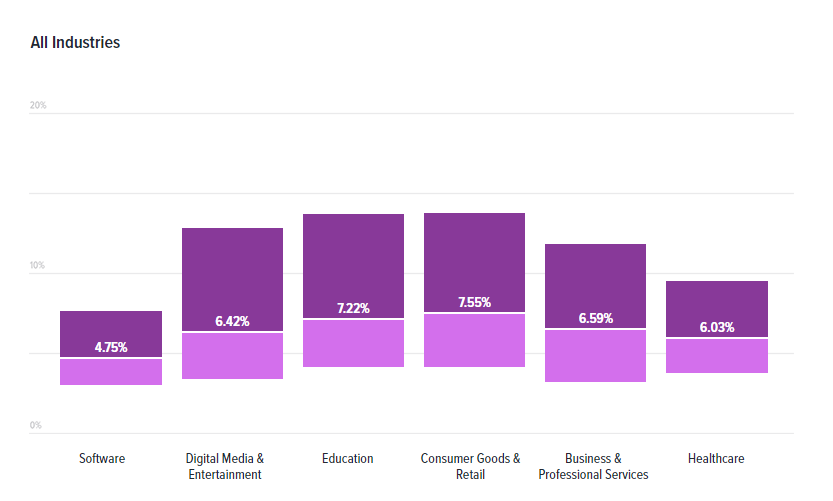

So what is a good churn rate?

According to Recurly Research, the average churn rate for business-to-business (B2B) companies is 4.91%. And the average for business-to-consumer (B2C) companies is 6.77%.

But a healthy rate for you depends on your business model and industry.

For instance, B2B churn rates are typically lower than B2C churn rates since they have a more complex and thought-out purchasing process.

Use this chart from Recurly to benchmark your churn rate against the average rate for your industry:

4 Business Metrics to Improve Customer Support

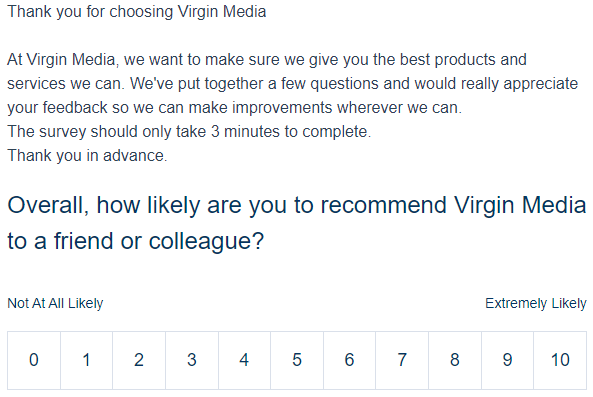

1. Net Promoter Score

Net Promoter Score (NPS) measures the likelihood of a customer recommending your product or service to others on a 0-10 scale.

It’s an important metric to track to gauge customer satisfaction and the word-of-mouth potential of your business.

For example, this email by Virgin Media asks customers how likely they are to recommend its products:

Consistently high scores mean you’re more likely to increase customer retention rate. And use their advocacy to bring in new customers, lowering your marketing costs in the process.

Conversely, low NPS can reveal problems with your product, offer, or customer service.

NPS are grouped into categories:

- Promoters (score 9-10) are loyal customers who champion your company

- Passives (score 7-8) are satisfied customers. But they might leave for a better offer.

- Detractors (score 0-6) are unhappy customers who might voice their opinions in negative reviews

To learn where your customers sit on the scale, track NPS with customer surveys.

It’s best to send these surveys after a purchase, subscription, or interaction with your customer service team.

That way, their experience with your product, service, or team members is top-of-mind.

Here’s the formula to work out your score:

NPS = percentage of promoters - percentage of detractorsSay you survey 100 customers. Sixty are promoters, 15 are detractors, and 25 are passives.

Your NPS will be 60% − 15% = 45%.

Further reading: The Complete Guide to (Effective) Customer Analysis

2. Average Response Time

Average response time measures how long it takes a team member to respond to a new inquiry or ticket.

Tracking this metric tells you how efficient your customer service team is.

Here’s how to calculate your performance:

Average response time = total time spent taken to respond to tickets in a given period / total number of customer messages in the same periodSay you had six tickets to respond to.

The individual times to respond to each ticket are one minute, five minutes, 10 minutes, seven minutes, 20 minutes, and six minutes.

Your average response time is (1 + 5 + 10 + 7 + 20 + 6) / 6 = 8.1 minutes.

A ticketing system like Freshdesk, Help Scout, or Zendesk will calculate your average response time automatically.

To improve average response time, ensure your team has the correct tools and training.

Also, make sure each customer service rep is handling a manageable number of tickets. So they aren’t overwhelmed and their response time doesn’t decrease.

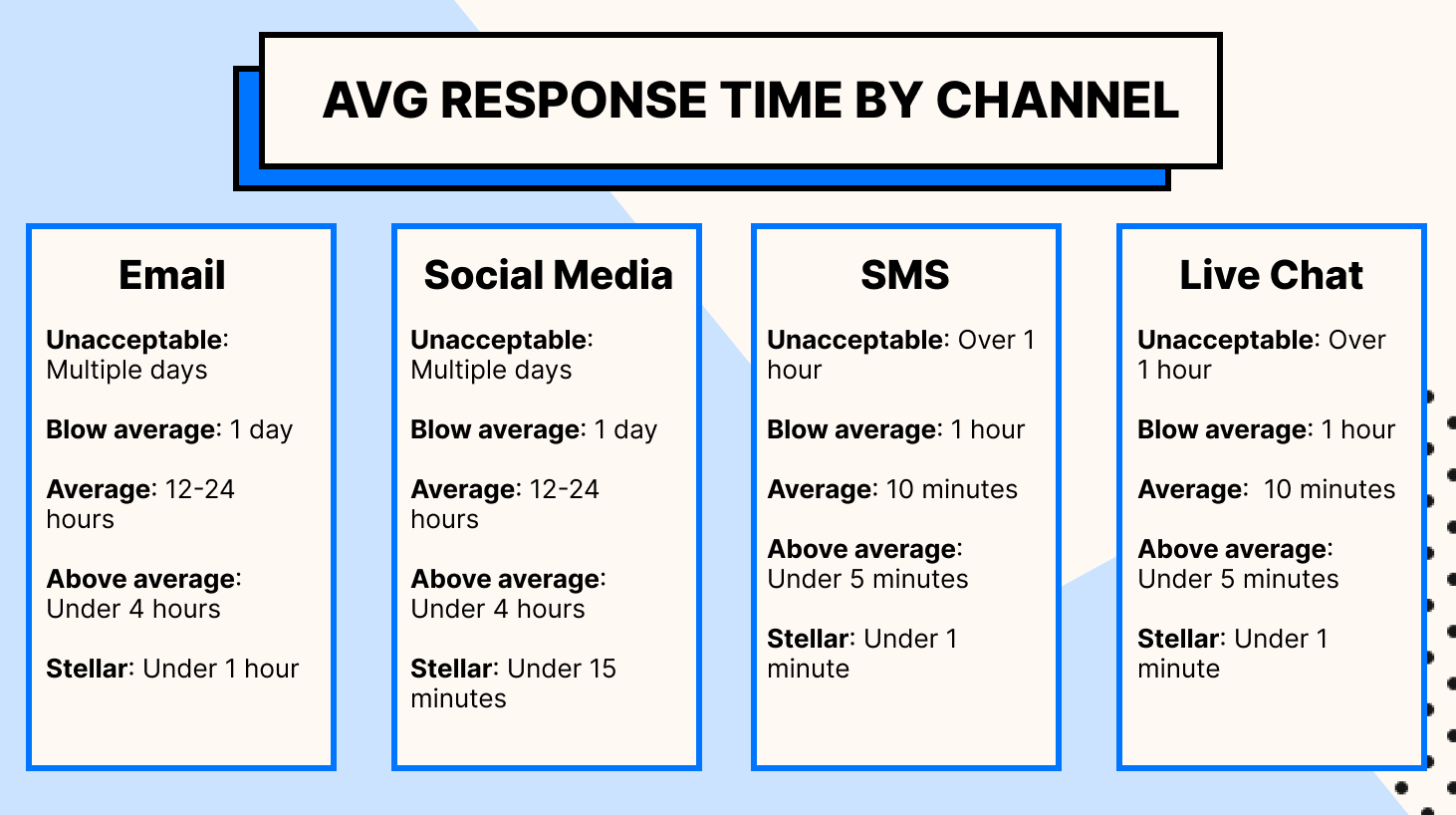

To benchmark performance, here are average response times by channel according to ecommerce helpdesk Gorgias:

3. Average Resolution Time

Average resolution time (also called mean time to resolution) is how long your customer service team takes to resolve an issue.

It provides insight into your team’s efficiency. It can also highlight complex issues that need addressing.

For example, if average response times are longer for problems related to a particular product or service, it’s a good chance to create help guides to reduce tickets. Or provide additional team training to solve problems more effectively.

Like average response time, speed is vital for resolutions. Solve problems efficiently to keep customer satisfaction high.

Here’s the formula to calculate average resolution time:

Average resolution time = total resolution time for all tickets solved / number of tickets solved.Say you solve five tickets in a day.

The times to resolve each ticket are 10 minutes, 60 minutes, 100 minutes, five minutes, and 45 minutes.

Your average resolution time for that day is (10 + 60 + 100 + 5 + 45) / 5 = 44 minutes.

If you use a ticketing system, you can track and calculate response time for service reps automatically, making it easy to monitor.

4. Social Media Monitoring

Social media monitoring helps you keep tabs on company mentions and maintain a positive brand perception.

Use a social media management tool to track social media channels so you can respond quickly to mentions and messages.

But also to understand feedback so you can improve your systems to address issues better.

Unhappy customers often use social media to contact companies and voice their frustrations.

Not responding creates a poor experience that can harm your reputation.

Why?

Because when a person calls you out on social media, everyone in that customer’s circle can see it.

They can also see your response (or lack thereof).

And if that post happens to go viral, you could be dealing with a public relations issue.

There isn’t one set metric for social media monitoring. Instead, track several indicators:

- Brand mentions

- Negative comments

- Product or service-related questions

Analyze performance month-to-month to understand trends and deliver consistent customer service.

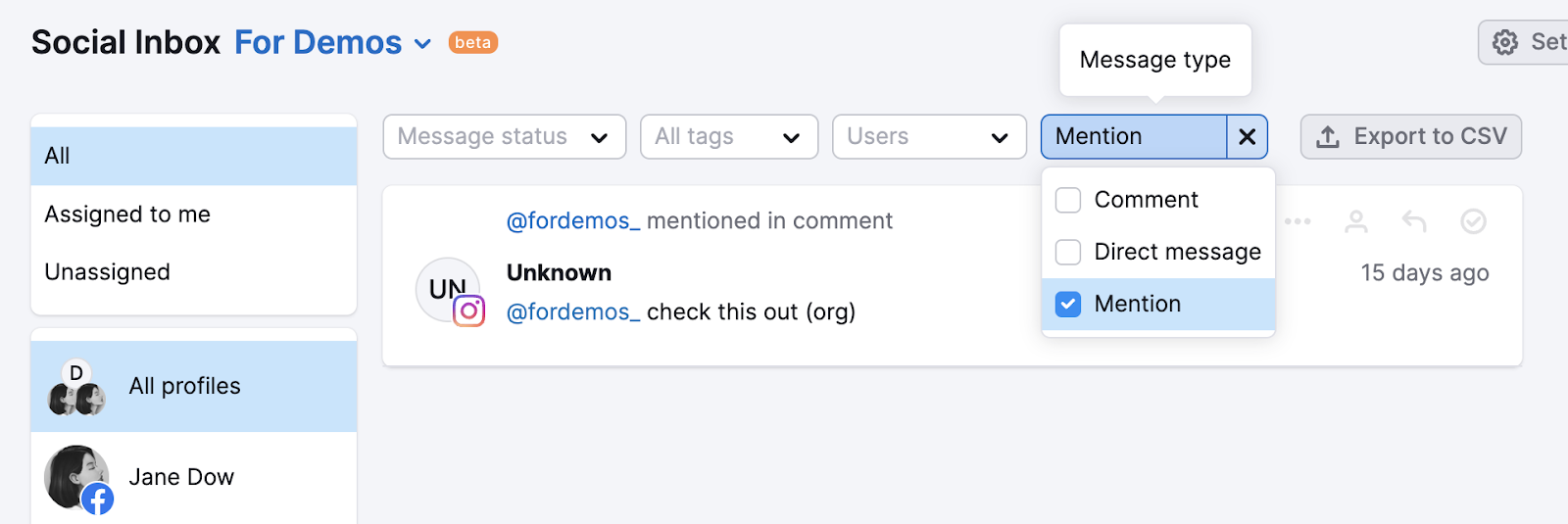

Semrush’s Social Inbox (part of the Semrush Social Media Toolkit) will help you monitor inbox mentions and provide quick responses.

It also lets you collect comments, messages, and mentions, so you can reply to them from a single dashboard.

Learn more: What Is Social Inbox and How Does it Work?

Top 3 Business Metrics for Finance Teams

1. Net Profit Margin and Net Income

Net profit margin is your company’s bottom line and one of the most important metrics for analyzing financial health. It measures how efficient you are at generating profit compared to revenue.

Monitor net profit margin quarterly to track income against the cost of running your business. So you can assess whether current practices are working and forecast future profits.

To calculate net profit margin, you first need to know your net income. The formula for this is:

Net income = total sales - cost of goods sold (COGS) - operating expenses - interest - taxes - depreciationSay you’re working with the following numbers:

- Sales: $100,000

- COGS: $30,000

- Operating expenses (e.g., rent, utilities, payroll, supply chain costs): $20,000

- Interest: $2,000

- Taxes: $2,000

- Depreciation: $500

Your net income is (100,000 − 30,000 − 20,000 − 2,000 − 2,000 − 500) = 45,500.

Now that you know your net income, you can work out your net profit margin using the following formula:

Net profit margin = net income / total revenueSo, if your net income is $45,500 and total revenue is $100,000, your net profit margin is 45.5%. Or nearly $46 of profit for every $100 sold.

2. Gross Profit Margin

Gross profit margin is the profit remaining after subtracting COGS from revenue.

Where net profit margin lets you track overall expenses compared to revenue, gross profit margin helps you understand how efficiently you produce products or services. It also allows you to analyze profitability trends.

Monitor gross margin to assess the profitability of your business model and whether you’re able to continue making money at your current price.

Say you sell furniture and outsource manufacturing.

If the price of materials and labor increases but your retail price stays the same, your gross margin will decrease.

Tracking it allows you to react to fluctuations. If you notice gross margin decreasing, you can increase your prices or consider a new manufacturing partner.

Use your net income to find your gross profit margin. Here’s the formula:

Gross profit margin = (revenue - COGS) / revenueYou track gross margin as a percentage. So, if your revenue is $100,000 and your COGS is $30,000, your gross profit margin is (100,000 − 30,000) / 100,000 = 70%.

3. Monthly Recurring Revenue

Monthly recurring revenue (MRR) is the summary of the revenue you expect to make in a month.

If you’re a SaaS company or offer a subscription model, MRR is an important metric to track.

Why?

Because it helps you predict future revenue, identify growth trends, and make strategic decisions.

Say you sell coffee subscription boxes.

By monitoring MRR, you see that you have a 10% growth rate. Using that figure, you can predict that revenue will double every seven months.

Calculate MRR using this formula:

MRR = number of customers x average monthly revenue per customerSo, if you have 500 customers paying $100 per month, your MRR is 500 × $100 = $50,000.

With this data, you can plan for the future. For example, you might increase your marketing budget to attract subscribers or hire more staff.

Similarly, if you see that MRR is decreasing, you can find the cause of the problem and make changes to increase customer retention.

3 Essential Business Metrics for Human Resources

1. Employee Satisfaction

Tracking employee satisfaction helps you maintain a happy and productive workplace.

Happy people are around 12% more productive, according to research by the University of Warwick.

Companies like Google have invested more in employee support and employee satisfaction has risen as a result,” Andrew Oswald, professor of economics at the University of Warwick, said. “For Google, it rose by 37%, they know what they are talking about. Under scientifically controlled conditions, making workers happier really pays off.

To keep satisfaction high, monitor happiness regularly. Run surveys to collect feedback. You can do this via internal emails or with an HR tool like BrightHR or citrus HR.

Use employee feedback to understand what they like and dislike about their role. And make improvements to keep your team motivated.

2. Employee Turnover Rate and Average Number of Employees

Tracking employee turnover rate helps you understand how many people leave your company and why.

It allows you to retain top talent and avoid the costly process of hiring and training new employees.

To get a clear picture, monitor total turnover rate and voluntary turnover rate. That gives context to the reasons people leave.

For example, if you restructure your company and your total turnover rate is high, you can attribute it to staff layoffs.

But if the voluntary turnover rate is high, employees are choosing to leave. That means you need to make changes to improve pay, conditions, or well-being to retain your best people.

Calculate turnover monthly, quarterly, or annually using this formula:

Employee turnover rate = number of employee exits / average number of employees Work out your average number of employees using this formula:

Average number of employees = employees at the start of the period + employees at the end of the period / 2Say your company had 30 employees at the start of the first quarter.

During the quarter, ten employees left and 20 new employees joined. Your final headcount for the quarter is 40.

That means your average number of employees is (30 + 40) / 2 = 35.

And your quarterly turnover rate is 10 / 35 = 28.5%.

So, what is a good turnover rate?

Research by Mercer shows the turnover rate in the U.S. from 2021-2022 was 24.7%.

But rates vary by industry. You can find updated turnover statistics on The U.S. Bureau of Labor Statistics Economic Daily website.

Therefore, it’s important to benchmark turnover rate against other companies of a similar size in your space.

3. Cost Per Hire

Cost per hire offers clear data on how much you spend to hire new talent. It’s an important business metric for leadership teams to ensure costs stay within budget.

Why?

Because it costs up to 40% of an employee’s base salary to hire a new employee with benefits, according to Zippia.

So if you’re recruiting a marketing specialist on a median salary of $77,000, it might cost you as much as $30,800.

Tracking cost per hire will give you clear data on how much you spend to secure new talent.

It will also help you budget for future hiring.

Say your average cost per hire is $1,000 and you’re planning to hire 20 new employees.

HR can expect to spend $20,000, plus room for inflation and increased service fees.

Calculate cost per hire quarterly or yearly using this formula:

Cost per hire = total hiring expenses / total number of hires in a periodSo, if you spend $50,000 hiring 25 new employees in the second quarter, your cost per hire is $2,000 ($50,000 / 25).

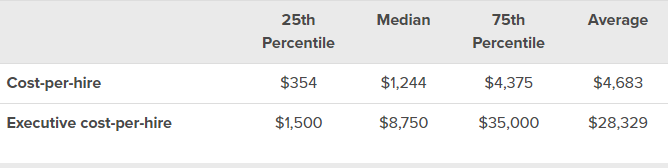

Research from the Society for Human Resource Management (SHRM) shows the average cost per hire is $4,683.

However, figures vary depending on role and recruitment process. So benchmark costs against the industry average and competitors.

Improve Business Performance with Semrush

Tracking business metrics keeps teams and stakeholders aware of performance so you can make confident decisions to grow your company.

Benchmark metrics regularly to build on what’s working and improve in critical areas.

Use Semrush to compare marketing metrics with your competitors and spot opportunities to increase effectiveness. That will ultimately help your bottom line.

Get started today with a free account.